According to the U.S. Department of Energy, replacing your decade-old unit could save you up to 50 percent on your monthly utility bill.

Continue ReadingRadon is a naturally occurring radioactive gas that comes from uranium in the soil. Although it exists in trace amounts all over the world, it can cause significant health problems if you happen to have a high concentration of it in your Ohio home.

Continue ReadingAside from the professionals, like ours at Downey PHCE, who really thinks about air conditioners and their components?

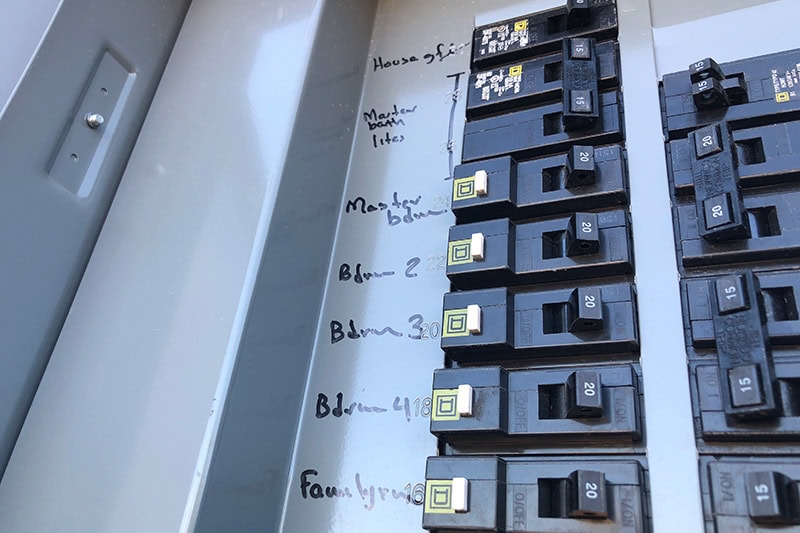

Continue ReadingAre you ready to join the electrification movement? Your Ohio home may need more power as you replace fossil fuel-burning heating, ventilation, and air conditioning (HVAC) equipment and kitchen appliances with electric ones.

Continue ReadingFrom replacing air filters to scheduling maintenance, cleaning your cooling system can prevent breakdowns and keep your home comfortable.

Continue ReadingYour electrical panel is at the heart of your Ohio home’s infrastructure, powering everything from appliances to smart devices.

Continue ReadingJust about any electrical appliance has the potential to overheat, and furnaces are no exception. As a homeowner, you need to take precautions to lower the risk of an overheated unit. You should also be wary of the associated symptoms so you know when to take action.

Continue ReadingYou can save up to 30 percent on your energy bill when you perform maintenance that supports ideal system efficiency, according to the IAQA.

Continue ReadingFurnaces are available in many shapes, sizes, and price points. The best choice will come down to your home’s size and heating needs. To find the perfect fit, schedule a preliminary visit with one of our Downey PHCE specialists. They can audit your Ohio home to determine the size of furnace you need. From there, you can narrow it down until you’ve found the perfect heating unit for your home requirements and budget.

Continue ReadingYou’ll be pleased to know that today’s gas furnaces burn at an efficiency rating as high as 97 percent, according to Consumer Reports.

Continue Reading